Residential Rebates and Incentives

2023 UPDATE FOR RESIDENTIAL HOME ENERGY EFFICIENCY REBATES AND INCENTIVES

Included in this page:

• OUR UNDERSTANDING

• REMODELS

• NEW HOMES

• BOOST INCENTIVES

• WEATHERIZATION ASSISTANCE

• RESOURCES

• GUIDES, FAQ, TAX FORM AND INSTRUCTIONS

OUR UNDERSTANDING

As with almost everything we do, rebates and incentives are different for every project because no two projects are the same. All Components that offer rebates or tax incentives should be thoroughly researched with the purchase date of the component in mind. Rebates and incentives are available in several ways:

Instore discounts for Energy Star components and appliances.

Mail-in rebates

Tax credits

Included below is an overview of programs available to both the homeowner and the builder. It can beconfusing who qualifies for what, but under the new Inflation Reduction Act, most remodeling and retrofit rebates are available to the homeowner and not the builder. New home tax credits go to whoever owns the land when the building is under construction. Here are some examples of how tax credits work. In cases when a home is remodeled to the level of Energy Star or Zero Energy ready, it may be possible for the homeowner to get the rebates available for home improvements, and the larger tax credit. In cases where a homeowner remodels a home and includes Energy Star products but does not affect the shell of the home, they may get rebates only, but every project should be studied to rule the tax credit in or out.

In cases when a homeowner has an undeveloped lot & hires a builder to build a new Energy Star or Zero Energy Ready home on the homeowner’s lot, the tax credit goes to the homeowner.

In cases where a builder owns the land and builds an Energy Star or Zero Energy Ready home, the builder who owned the land while the construction was underway is eligible for the tax credit, even if the home and land was sold at the end of the construction.

Cautionary Disclaimer: For some components like heat pumps the rebate is easy to qualify for, but other components, like windows, have more stringent criteria to qualify. Research each component to understand the requirements. All rebates, tax credits, and other incentives are subject to change. This publication is only meant as a guide for navigating a very complex assortment of information. Consulting a tax professional may be necessary and recommended to understand eligibility.

REMODELS

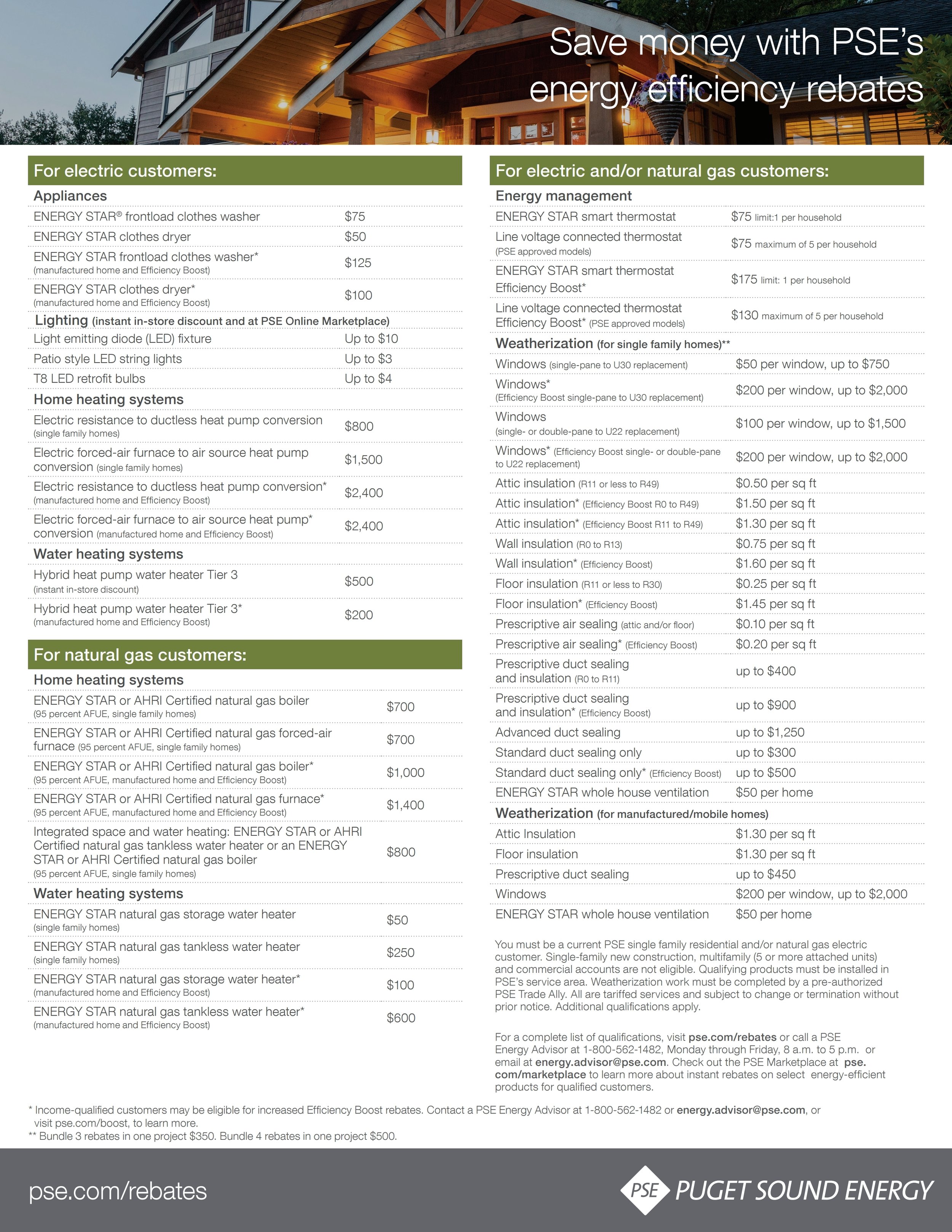

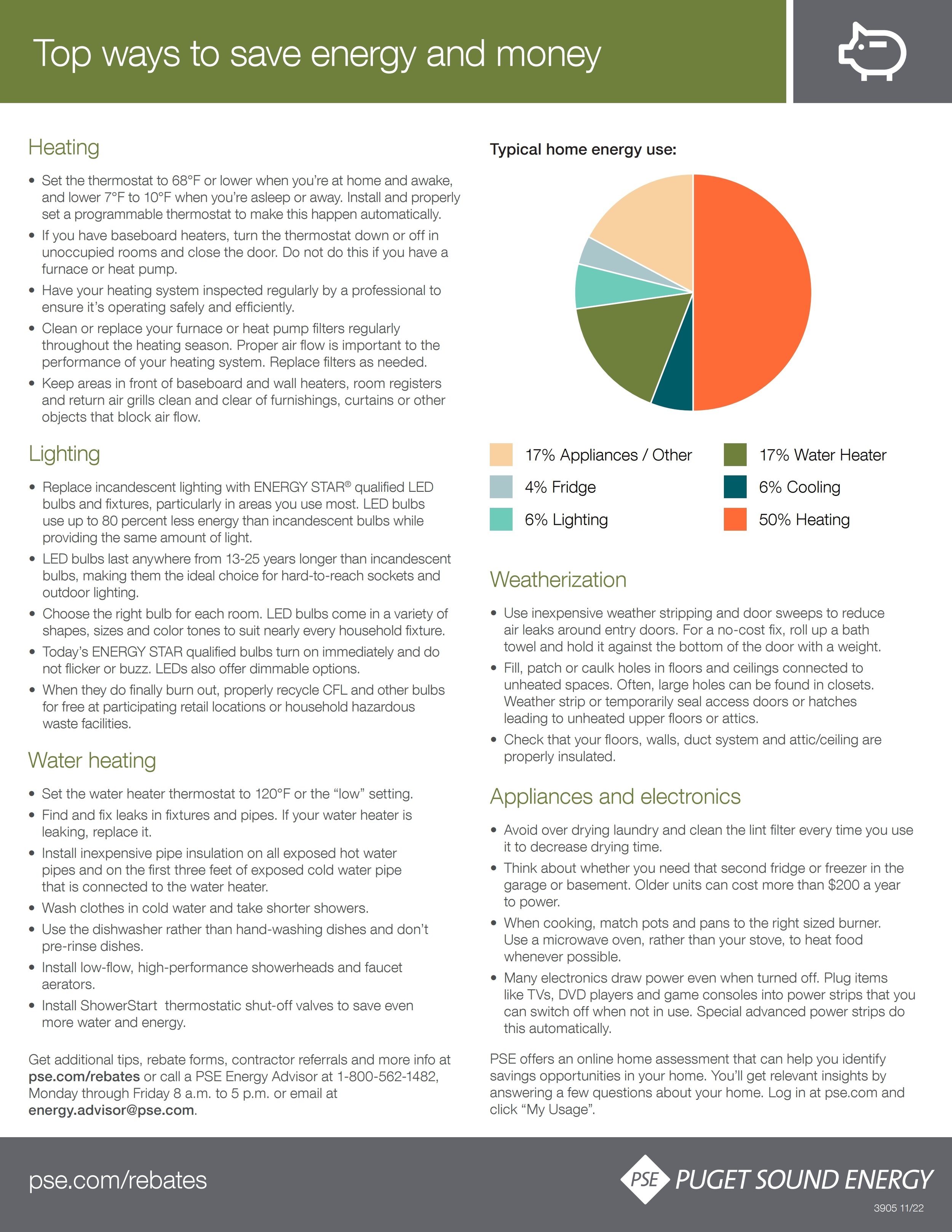

Savings of up to $3,200.00 annually are available for homeowners when remodeling or upgrading existing components. These savings are in various forms for homeowners and there are specific qualifiers that can be found on the PSE site, or the energystar.gov site, or by using the Rebate finder:

Air source Heat Pumps

Central Air conditioners

Boilers

Biomass fuel stoves

Furnaces

Heat pump water heaters

Natural gas, propane, oil water heaters

Insulation

Windows & skylights

Exterior doors

Geothermal heat pumps

Small wind turbines

Solar Energy

Fuel Cells

Battery storage technology

Electric panel upgrade

Home audit

Smart Thermostats

NEW HOMES

The high-performance home rebates require a certified rater consultation in design and build phases, this is normally managed by the builder. The tax credit goes to who ever owns the land at the time of construction and is $2500.00 for homes rated as energy star certified. Larger tax credits are available for DOE’s Zero Energy Ready (ZERH) Program. The certification stays with the home. The benefit to the homeowner is realized in energy savings and improved market value of the home and tax credits if they are the land owner from the start. “These studies have shown sale and re-sale price premiums ranging from 2% to 8% in most markets for rated, energy-efficient homes, including ENERGY STAR certified homes.” -energystar.gov

MANUFACTURED HOME REBATES: Rebates of $2,200. to 4,400.00 for Energy Star certified manufactured homes, available to the home purchaser and $2500.00 available to the manufacturer.

BOOST INCENTIVES

Boost incentives are based upon homeowner income. Homeowners with lower incomes can get larger incentives as compared to the standard incentives. This program is offered by energy.gov and available through PSE.

WEATHERIZATION ASSISTANCE

Weatherizing an existing structure using a PSE Recommended Energy Professional or trade Ally will result in rebates. The rebate comes to the homeowner through the contractor who performs the work. The Opportunity Council for Whatcom County has several program opportunities.

From Pudget Sound energy…

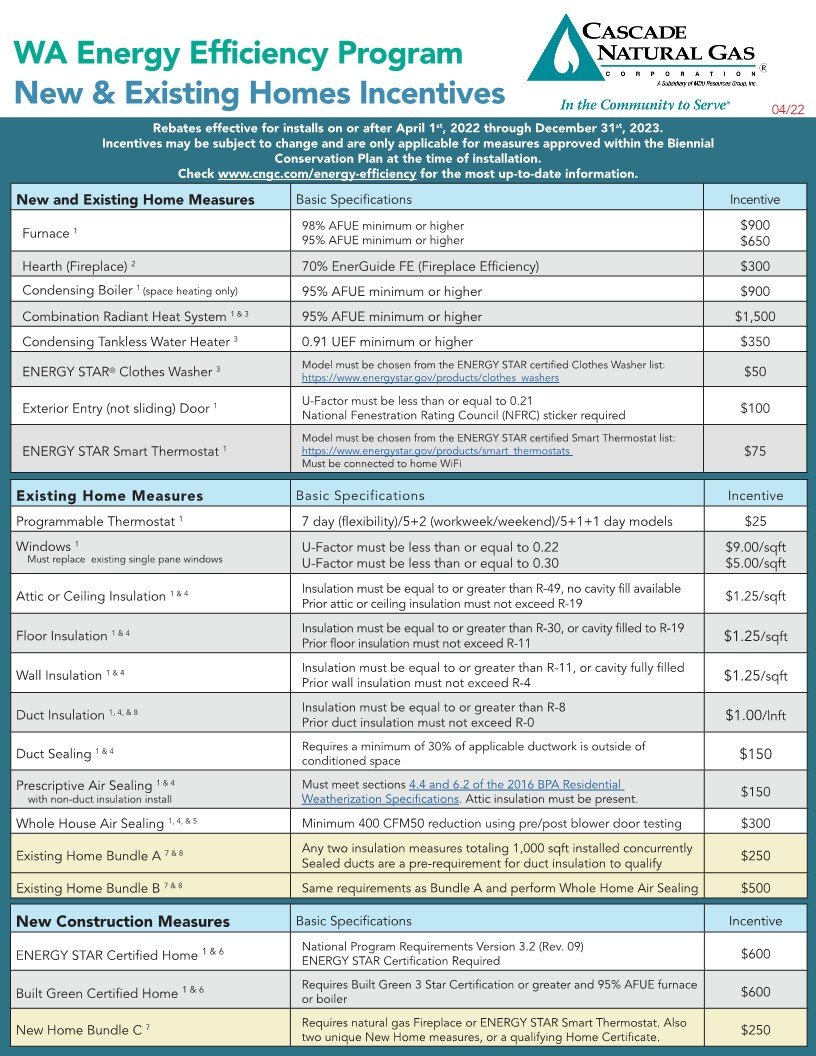

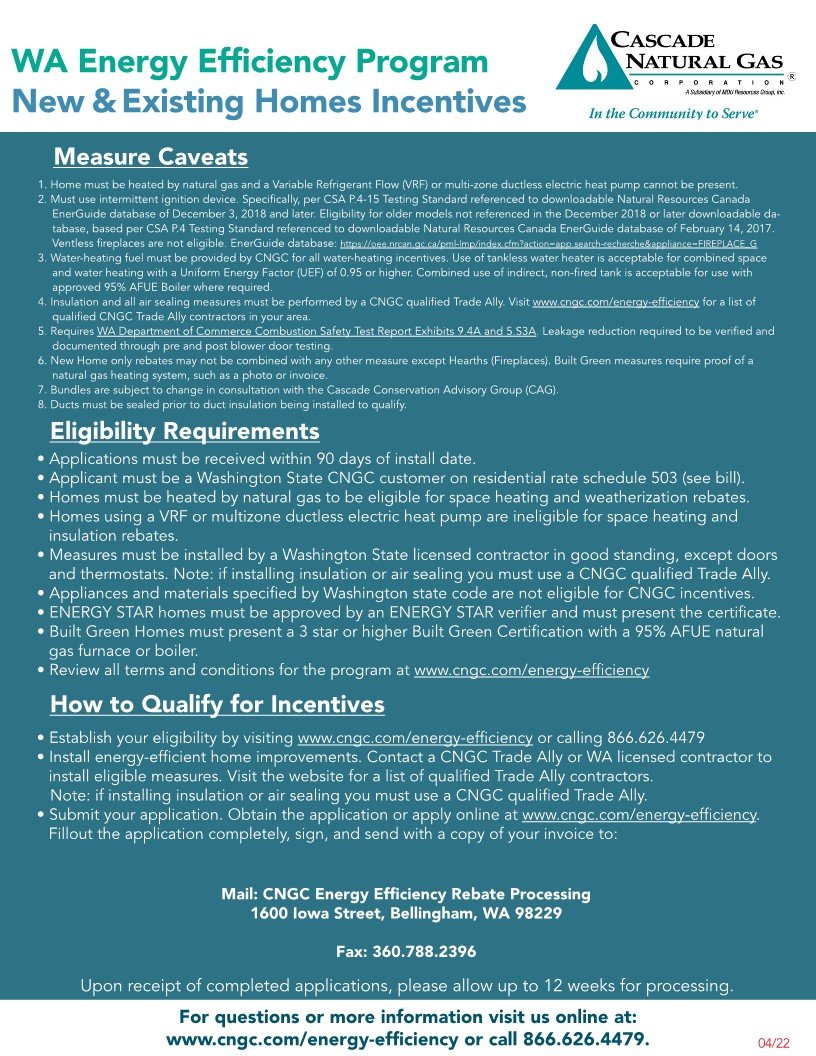

From Cascade Natural Gas . . .